(This is part of a series: start here if you please.)

The Market view is starkly different from the Polis concept outlined in the previous post. In some ways it’s better attuned to the individualized, consumer-centric trends beginning to dominate the health sector. It’s less interested in top-down systems thinking and more confident in the emergent behavior of bottom-up forcings.

The Market view is starkly different from the Polis concept outlined in the previous post. In some ways it’s better attuned to the individualized, consumer-centric trends beginning to dominate the health sector. It’s less interested in top-down systems thinking and more confident in the emergent behavior of bottom-up forcings.

Price Check, Please

The Market is significantly less concerned with volume than the Polis, though it irons out that wrinkle in turn. As documented in It’s the Prices Stupid and international surveys, the primary dysfunction of our system is wrapped up in its pricing mechanism. We have fewer and shorter inpatient stays, buy less health care than our Western peers, yet we pay so much more per unit for everything we consume. And therein lies the bankruptcy, moral and otherwise, of our system. It’s why we can’t go on like this and why our teeming masses can’t access care; it’s also, for many Market adherents, why misguided attempts to extend access to those masses before or without addressing the pricing issue is a project doomed to failure (financial catastrophe, to be more precise).

Unnecessary volume may well be a problem, but individual consumers with the proper financial incentives will solve both the volume and the price problems. Let's meet one of the heroes of the Market philosophy: the deductible. This is the amount an individual puts toward insurance-covered health services from in-network health care providers before the health insurance plan kicks in to start paying its share (the deductible is an annual amount so once you've spent that much cumulatively, you're done with it for the year). Imagine you've got a $1,000 deductible and five different health care providers are providing a particular service at a range of price points:

Unnecessary volume may well be a problem, but individual consumers with the proper financial incentives will solve both the volume and the price problems. Let's meet one of the heroes of the Market philosophy: the deductible. This is the amount an individual puts toward insurance-covered health services from in-network health care providers before the health insurance plan kicks in to start paying its share (the deductible is an annual amount so once you've spent that much cumulatively, you're done with it for the year). Imagine you've got a $1,000 deductible and five different health care providers are providing a particular service at a range of price points:

The deductible will make you more price sensitive, but generally only for those services priced below your deductible. In this example, you could save $250 by getting a procedure from Provider A. But if Provider A for some reason wasn't acceptable to you, the deductible would offer no help in choosing between Providers B, C, D, and E because your cost for each of them would be the same: $1,000, the full value of your deductible. The higher your deductible, the more health services will fall beneath it and the more competitive those particular services will be for your business. Deductibles, and the price sensitivity they engender on the part of consumers, are critical to the Market, and in general the higher the deductible the better.

In the Land of the Blind Monopolist, the One-Eyed Consumer is King

The fundamental philosophical precept defining the Market approach is that decision-making autonomy has been removed from the hands of the consumer and placed into the hands of third parties like employers and health insurers, dampening the incentive for cost consciousness. In the Market, the patient-as-consumer is once again empowered. Competitive forces are drawn upon to check—if not outright break—constantly rising prices in the health sector. Collusion, encouraged by government policy influenced by the Polis philosophy, is overcome by the sheer will of millions of price conscious shoppers finally, at long last, saying “no more” and voting with their feet and wallets.

In the Market, consumers begin to treat at least some aspects of the health care landscape like other commodities or consumer goods. Witness the rise of services like ZocDoc:

Online services such as ZocDoc and InQuicker are enabling patients with non-life-threatening conditions to schedule everything from doctor's office visits to emergency room trips on their laptops and smartphones — much like OpenTable users do with restaurant reservations.

Hospitals and doctors increasingly are subscribing to the services to simplify appointment scheduling for patients who dislike waiting on hold and are comfortable doing everything from shopping to banking online.

With most of the services, booking is as simple as going to a website, entering a zip code and the kind of care needed, and checking available times. Patients can get a doctor appointment within a couple days, even if they're a new patient. And the services say most patients are seen within 15 to 20 minutes of their appointment, and when an ER backs up, patients with reservations are texted to come later.

Empowerment of the individual consumer requires greater price transparency for health services. But price transparency without the associated financial incentive on the consumer side is toothless at best, counterproductive at worst. Pioneers like the state of Massachusetts, which now requires insurers to make available to their subscribers the prices health care providers charge, and Blue Cross Blue Shield of North Carolina which is doing so voluntarily are showing how price transparency tools can work.

But let's go back to the example of having a $1,000 deductible. Imagine you log into your insurer's website for a handy, transparent price comparison for a health procedure and see the following:

Huzzah, you've found that Provider A's prices are far lower than Provider C's. But they're all at or above your deductible, meaning it costs you the same thing to go to any one of them. So you may well assume (not-quite-correctly) that Provider C's higher price must reflect a commensurate higher quality, or you may decide that you'd be getting quite a deal by going to Provider C (paying only a grand for a $5,000 procedure--what a steal!). In other words, transparency with no "skin in the game" on your part may perversely push you toward the higher cost health care provider. If, on the other hand, you had a $3,000 deductible you might rule Provider C out right off the bat. In fact, it might well push you firmly toward Provider A. And this is the logic underlying the Market--price exposure puts you in the driver seat and thus rationalizes your choice.

Just last week, Public Agenda released a poll showing how Americans understand and use prices in health care. Almost unbelievably, 57 percent of the insured and 47 percent of the uninsured weren't aware that different physicians might charge different prices for a given service. That's the definition of a broken market. As one might expect, the higher one's deductible, the more likely he is to try and learn about comparative price information (see the figure to the side, borrowed from their findings).

A powerful argument for higher deductibles (which may mean a $1,500 deductible, not a $6,000 deductible), if we accept that premise that consumers ought to take an interest in the price of the services for which they're shopping.

| Provider A | Provider B | Provider C | |

| Procedure Price | $1,000 | $2,100 | $5,000 |

| Your Cost | $1,000 | $1,000 | $1,000 |

Huzzah, you've found that Provider A's prices are far lower than Provider C's. But they're all at or above your deductible, meaning it costs you the same thing to go to any one of them. So you may well assume (not-quite-correctly) that Provider C's higher price must reflect a commensurate higher quality, or you may decide that you'd be getting quite a deal by going to Provider C (paying only a grand for a $5,000 procedure--what a steal!). In other words, transparency with no "skin in the game" on your part may perversely push you toward the higher cost health care provider. If, on the other hand, you had a $3,000 deductible you might rule Provider C out right off the bat. In fact, it might well push you firmly toward Provider A. And this is the logic underlying the Market--price exposure puts you in the driver seat and thus rationalizes your choice.

|

| Shoppers with higher deductibles are more price conscious |

A powerful argument for higher deductibles (which may mean a $1,500 deductible, not a $6,000 deductible), if we accept that premise that consumers ought to take an interest in the price of the services for which they're shopping.

The Anti-System

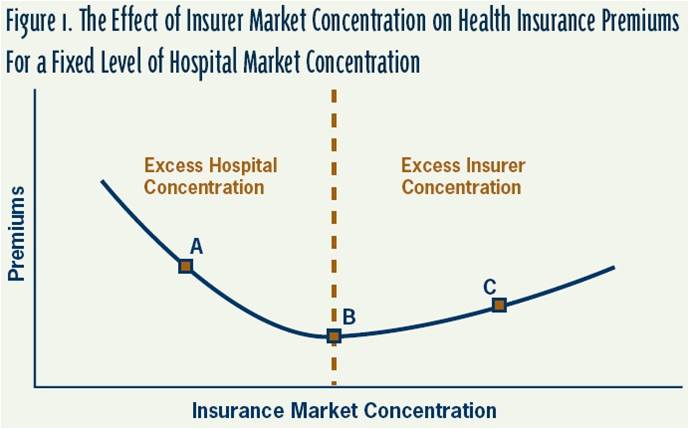

A “health system,” so central to creating the integrated care experience of the Polis and providing the “whole patient” care experience touted by Dr. Gottlieb in the previous post, is a perversity in the Market. Monopolies or oligopolies, with common ownership and/or management of disparate actors in the health system, simply give consolidated entities the opportunity to drive up prices in their negotiations with payers who are themselves likely exhibiting the telltale symptoms of market concentration. Bilateral oligopoly, an idea we’ve touched on before, may be the only “antidote” (perhaps coupled with government regulation) to total price domination in this state of affairs, but a functioning market it does not make.

|

| Bilateral oligopoly--costs balance, like a pencil on its tip, between dueling giants. h/t to the Incidental Economist |

The Market embraces disparate, un-entangled health care providers competing for business, providing the incremental health care services desired by the consumer and not colluding unnecessarily with erstwhile competitors. Patient information may be shared freely across providers insomuch as it belongs to the patient.

The Polis, in so many ways intricately linked with the philosophy (if not the model itself) of the patient-centered medical home, which is based on fostering a continuing, longitudinal connection between the patient and a clinical team led by a trusted primary care physician, stands repudiated! Here we have convenience medicine, an available physician or specialist a mere Open Table-esque app appointment away, the choice dictated by a brutish combination of price and availability at the patient's desire. So, too, with the rise of retail clinics that can handle minor ailments and urgent care clinics that treat pressing but not-quite-ER-acuity injuries or problems.

Of course, not all ailments are minor or cheap enough to be addressed through the convenience of a drop-in at the nearest Medical 7/11. The Market acknowledges this but relies heavily on a critical policy instrument, the consumer-directed health plan (CHPD), to retain some semblance of market dynamics as patients descend deeper into the Dante-esque lower layers of the health system. The CHPD is a high-deductible health insurance plan, coupled with a Health Savings Account (HSA) that allows you to pay for the insurance plan’s increased cost-sharing with tax privileged dollars you’ve stashed away for just that purpose. The HSA is meant to make the extra out-of-pocket spending you take on more palatable and manageable.

The theory, of course, is that the more financial responsibility one bears at the point of care, the more responsible the individual will be in identifying and choosing high-value health services. A critical overlap with the Polis! (Though the Market places more of the impetus for identifying value on the individual, while the Polis makes this a responsibility of the system itself.) But deductibles are limited, useful only for relatively low-cost, generally outpatient, services whose total price lies below the deductible. When one’s deductible is $1,000, his liability for the cost of an inpatient procedure remains $1,000 regardless of whether a hospital has priced a procedure at $20,000 or $35,000. Enter the reverse deductible: reference pricing.

Some organizing actor (perhaps an employer group, or theoretically an employer) chooses a particular price for a high-cost procedure. If you choose to get the procedure from a higher-priced provider, you pay the different between the reference price and your chosen provider's price. One example of this strategy resulted in the highest-priced providers dropping their prices dramatically, while other studies of this strategy have suggested we ought to check our enthusiasm for it until more data is in. Regardless, it's quite an administrative challenge to pull off effectively, and can only be used for select non-urgent procedures that lend themselves well to shopping and active consumer choice.

The Networks Pickle

The Networks Pickle

The Affordable Care Act’s exchanges are an example of what competition is supposed to achieve. Insurers in these new marketplaces are forced to compete on a transparent, level playing field which means if they want to attract customers they need to keep their premiums (and thus their costs) down. And so they’re doing something they’ve rarely bothered to do in the past: they’re aggressively working to reign in costs. These insurers are clamping down on reimbursement rates to health care providers and they're not afraid to cut high-cost providers out of their networks if they won't play ball.

In my estimation, in the new era of the ACA health insurers have a handful of tools available to them to try and contain costs:

In my estimation, in the new era of the ACA health insurers have a handful of tools available to them to try and contain costs:

- Smarter benefit design (pushing shoppers toward high-value services and providers) which inherently relies on greater cost-sharing through tools like deductibles, as does any Market approach

- Active population health management to not only preserve health but address deficiencies in the health care delivery system that drive up spending (a Polis-inspired idea that in practice means assisting health care providers in this function), and

- More selective provider contracting/network design to attack price growth growth, in part by taming or exiling unjustifiably high-priced providers (which is perhaps some sort of Polis-Market hybrid).

Historically the inability of insurers to credibly threaten network exclusion has weakened their negotiating hand and allowed health care providers to extort ever higher reimbursements. In the exchanges, this has (so far) been less of a concern. Even with federal subsidies cushioning the cost, exchange shoppers are incredibly price conscious and insurers have gambled--and won--on the assumption that shoppers will trade wide networks with every-doctor-in-the-book for lower premiums and narrower provider networks. Happily, McKinsey has found "no discernible differences in performance on these [quality] scores among the hospitals participating in ultra-narrow, narrow, and broad networks." In other words, the cheaper exchange plans offering fewer doctors and hospitals to choose from aren't generally offering a lower quality product.

But, as we might expect, the denizens of the Polis might find this narrow network Market concoction abhorrent! The Polis envisions a world built around integrated systems (like ACOs) that can effectively manage the health and costs of defined populations. They're purposive, designed systems. Cobbling together unconnected providers (even if individually they do well on respected quality metrics)--whose only formal relationship is appearing on the same page of an insurance website's provider directory--does not a coordinated system make, even if that assortment of providers collectively satisfies regulatory network adequacy requirements.

Preach it, Harold!

Harold Miller, president and CEO of the Pittsburgh-based Center for Healthcare Quality and Payment Reform, says narrow networks could undermine efforts to boost coordination of care.

"The dictionary defines a network as a 'group or system of interconnected people or things.' But a health plan's network is typically nothing more than a list of providers," Miller said this week.

"There may be no connections whatsoever among the providers on the list, and a short list of providers chosen based on price may be even less likely to have connections than a longer list… At a time when there is a strong national focus on improving coordination of care, forcing patients to use providers who don't have any connections to each other might result in lower prices for individual services but higher overall spending, since the providers in this kind of 'network' will be more likely to order duplicate tests, perform unnecessary services, and fail to prevent problems that require expensive treatment."

Narrow networks have the potential to rattle care coordination, he says. "If the narrow network is the only choice the patients have, it's even more problematic because, almost by definition, it means that many patients will have to change doctors, which will disrupt continuity of care."A valid (and confounding point). If you read the Speakeasy back in '09/'10--and I doubt you did--you know I was a big proponent of the "robust" (price-setting) public health insurance option proposal for health reform that ultimately failed. And the reason was that I thought only that threat of a lower-priced government competitor would drive insurers in the ACA's exchanges to really focus on cost containment. I'm happy to say I was wrong. There's no public option but good old-fashioned market competition in the exchanges has forced the exchanges' insurers to cater to price-sensitive consumers and one of the ways they've kept insurance plan costs down (up to 20%(!) below comparable employer-based insurance plans) is by narrowing networks to keep negotiated reimbursement rates low. A true Market solution! But completely disconnected from the Polis ideal of the integrated, thought-out system.

Paging Mr. Simon

As we have so many times in the past, we return to a fundamental concept: bounded rationality. People are not calculators. They’re human beings, with all the other burdens of life consuming cognitive bandwidth, all the other limitations of the cognitive process constricting the tidy picture of an arbitrarily rational being making decisions. And just as Herbert Simon put some limits on any economic theories based on infinitely rational human actors, some cold hard facts throw cold water on any ideas too deeply rooted in the rationalist Market philosophy.

|

| Most people contribute almost nothing to national health spending; a tiny sliver of the population accounts for most spending. |

If it’s the chronically ill, those with multiple, complex conditions driving up spending then how can we expect a deductible to matter? How can we rely on any half-baked effort to make them “more discerning shoppers” to be successful? These are people who blow through deductibles due to the sheer volume of services they require. At best, the "price sensitivity" of the Market is best oriented toward the healthiest, lower-utilizing segments of the population. Those who account for only a small fraction--less than a fifth--of total health spending.

And so the Market seems to hit a wall when we consider the expensive, complex patients whose situation calls out for a Polis-esque organizational change in care delivery (emphasizing coordination, efficiency, and a whole-person approach to multi-faceted health challenges), just as the Polis seemingly ran into a wall when confronted with the challenge of consistently higher prices for health services in this country. But before we consider some reconciliation of these ideas, a brief interlude that puts our conundrum in concrete terms.

No comments:

Post a Comment